Citi has taken a bold stance on blockchain, reflected by the fact over 50% of the day’s content at Digital Money Symposium was focused on digital assets in some shape or form, whether exploring payments, embedded finance or transparency. But is it only lip service?

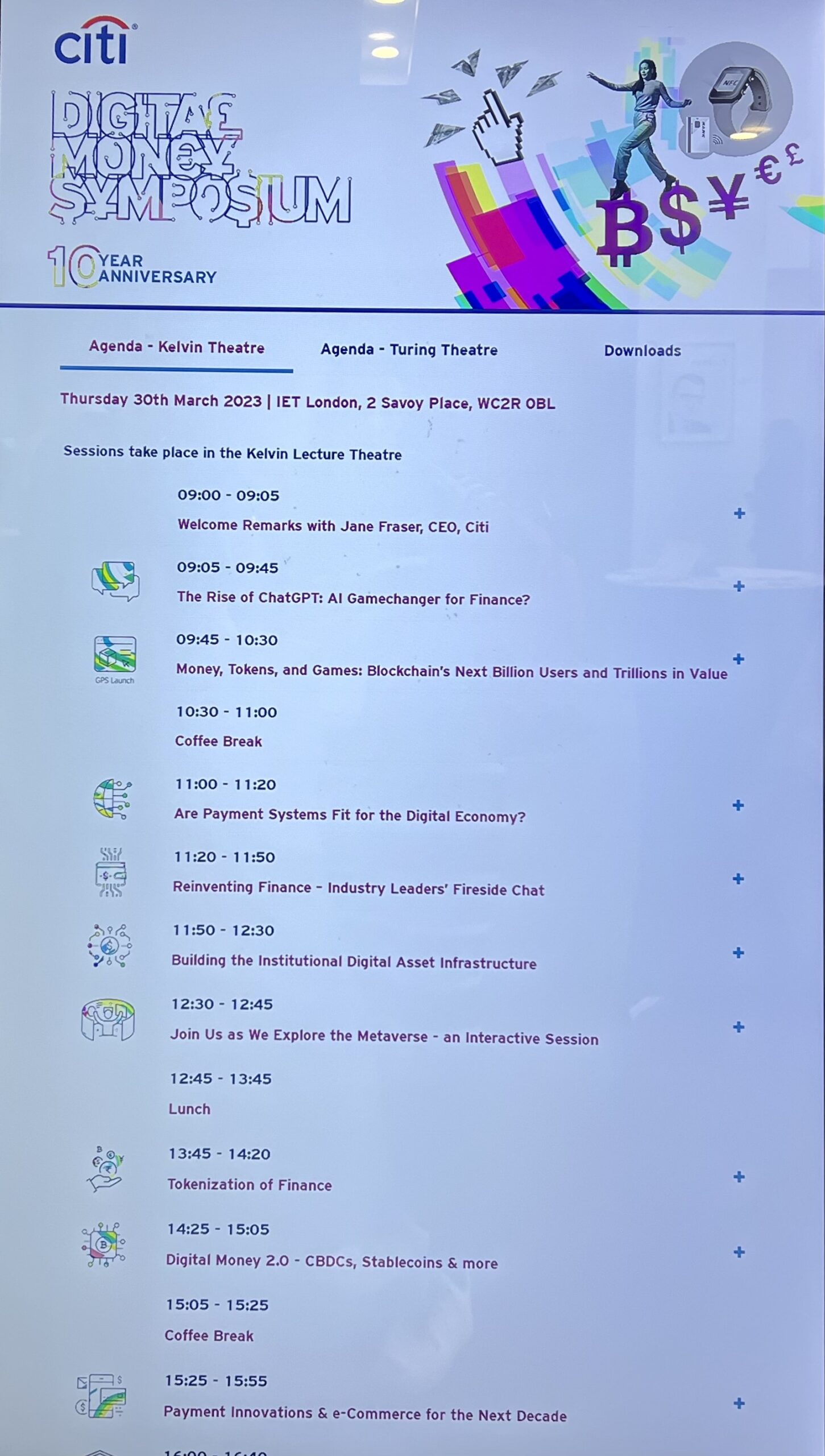

I recently had the great pleasure of attending Citi’s 10th Annual Digital Money Symposium, held in London. As one of the world’s largest financial institutions, operating across all major established and emerging markets, Citi is certainly well placed to run such an event – and it didn’t disappoint.

It brought together a range of practitioners in the fintech and digital money ecosystem, including thought leaders, academics, corporates and – of course – the policy makers who help bring everything together.

Citi has taken a bold stance on blockchain, reflected by the fact over 50% of the day’s content was focused on digital assets in some shape or form, whether exploring payments, embedded finance or transparency. But is it only lip service?

I think not, given Citi has backed up the talk with the release of an intriguing new in-depth report, which was at the heart of the event and is entitled ‘Money, Tokens, and Games: Blockchain’s Next Billion Users and Trillions in Value’.

A bullish industry gazing into the future

Disruptive technologies have changed the way we do things: how we live, work, spend, invest and interact. The report explores some of the main drivers that will take blockchain technology to the next billion users, and potentially trillions of dollars of economic activity.

I found the day’s first session absolutely fascinating. In ‘The Rise of ChatGPT: AI Gamechanger for Finance’, the panelists looked at how ChatGPT has caught mass public attention and is close to its ‘iPhone moment’ with widespread consumer adoption on the horizon, and then compared it to blockchain, which is perhaps a little longer from mass adoption due to the need for collaboration amongst participants, standardisation of platforms and interoperability with existing systems. As Dara Tarkowski from Actuate Law explained, ChatGPT offers a huge opportunity for cross-sector collaboration, and I believe blockchain offers the same.

The prevailing mood was bullish about the prospects of digital assets. In the fireside chat, ‘Reinventing Finance’, 10xBanking’s Antony Jenkins and Ping An Group’s Jonathan Larsen, both Citi alumni, didn’t hold back on their perception of how fintech is developing with revolutionary technology that they wish they had while working at traditional financial incumbents. It’s clear both made the move to alternative finance to pursue genuine innovation and make a real difference.

Moving back to Citi’s report, Ronit Ghose, from Citi Global Insights, led an interesting session that explored its key findings, saying that blockchain is fuelling the creator economy and has given people a sense of power and control.

However, blockchain as a disruptive technology is different from many others. Because it involves the transfer of financial value, it enters the realm of money – which is a highly-regulated domain in most countries. So whilst the blockchain revolution began on the periphery, to achieve mass adoption it needs the support of sovereign institutions, regulated financial institutions, and large corporates – as well as the rebels!

This really hit home for me. As an enterprise-focused, digital-asset-as-a-service platform, Zumo’s API-based infrastructure offers a fast, flexible and compliance-sensitive route to market, empowering banks, asset managers and other brands to offer their clients the tools of the future simply, securely and sustainably.

So, why does Citi believe the growth of blockchain by 2030 will be measured in billions and trillions?

Billions of users..

Citi predicts that blockchain user numbers will be greatly boosted by daily activity, spanning money, games, social media and much more. Successful blockchain adoption will be when it has a billion-plus end users who don’t even realise they are using the technology.

In terms of money, it’s expected that countries with populations totalling around 2 billion are likely to experiment with DLT-linked central bank digital currencies (CBDCs).

Citi believes the next generation of gaming will include tokenised assets, initially driven by the Asian gaming market and appealing to power users. And then when it comes to social interactions, micropayments – including in Metaverse games – will likely be blockchain-based. It’s also anticipated that large consumer brands will help power Web3 adoption. This certainly looks likely, with brands such as Adidas, Nivea and Pepsi already extremely active in the space.

Generating trillions of dollars

Citi thinks that up to $5 trillion could move to newer digital money formats, such as CBDCs and stablecoins by 2030, of which roughly half could be blockchain-linked. Legal reforms and greater interoperability could then drive up to $1 trillion of tokenisation in global trade finance by 2030.

Securities and funds are seen as the big tokenisation prize for the private sector. Citi also estimates up to $5 trillion of non-financial corporate and quasi-sovereign debt; repo, securities financing, and collateral market; and alternative assets, such as real estate, private equity and venture capital could be tokenised by 2030.

Of course, bringing billions of users and trillions of dollars of investments into the blockchain ecosystem will require a change in the technological, regulatory and legal plumbing. Looking ahead, changes could include blockchain-based identity solutions, privacy solutions enabled by zero-knowledge proofs, and Oracles to connect real-world data on-chain.

But first, we need a strong regulatory and legal framework that allows individuals and institutions to embrace this new technology, and all that’s on offer. Good timing, then, for HM Treasury to be running a consultation that sets out proposals for the UK’s financial services regime for cryptoassets (more about which here for those interested).

I left the event feeling inspired. With committed collaboration, there is no limit on what we can achieve together.