How do companies, organisations and financial institutions assess emerging areas of opportunity within the global digital asset ecosystem?

In a world driven by digital transformation, the role of blockchain and digital assets has taken centre stage in the corporate arena. Yet, the specific roadmap for implementing these technologies remains shrouded in uncertainty.

From tokenisation to decentralised finance, central bank digital currencies to distributed ledger technology, the terminology abounds. Understanding the relevance, maturity, and potential of these opportunities from an enterprise perspective has become a driving imperative.

Increasingly, this encompasses a more and more substantial terrain, all the way from a bank employing a private blockchain for financial market infrastructure operations to a retail brand implementing an NFT-based loyalty program or a fintech company offering a blockchain-powered payment system for merchants.

In a landscape in which boundaries blur and definitions often become muddled, what is required is a holistic perspective of the digital asset and blockchain ecosystem, and a reasoned starting point from which to craft enterprise digital asset strategies.

In this short article, we look at how existing and emerging digital asset enterprise opportunities may be categorised within a deliberate framework as a starting point for navigating the emerging digital asset enterprise landscape.

Towards a working framework

To create a functional framework for the enterprise digital asset landscape, it’s essential to trace the journey from ‘crypto’ to ‘digital assets for enterprise’ to its roots. How did ‘crypto’ transition into ‘digital assets’ into ‘digital assets for enterprise’ in the first place?

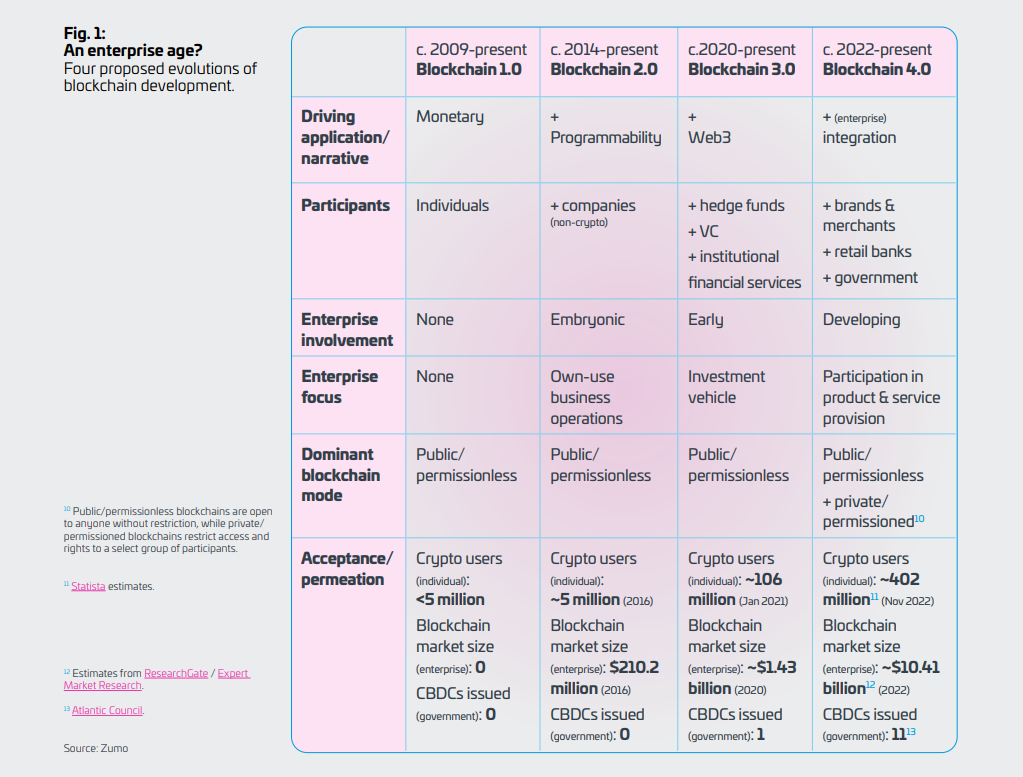

One way you could look at this is through two key axes of evolution: a shift from monetary investment towards generalised use cases on the one hand; and individual to institutionalised offerings on the other. A useful way to bring that to life is to follow the journey by considering different ecosystem iterations and the evolving participants and applications associated with each.

Interpreting it in this sense, ‘blockchain 1.0’ – defined by the advent of the Bitcoin blockchain – represents the birth of cryptocurrency. As a digital currency for direct individual transfers, Bitcoin was both financially oriented and aimed at individual users with no intermediary involvement. At this early stage, there was no significant enterprise participation: crypto(currency) dominated the scene.

‘Blockchain 2.0’ brought Ethereum into the picture, introducing the concept of smart contracts and more sophisticated embedded logic. This period marked the realisation that blockchain could serve a broader range of purposes beyond the original Bitcoin vision. Enterprises began exploring commercial blockchain applications, and more sophisticated investment products emerged. The ecosystem grew to include new participants and diverse applications, with enterprises primarily experimenting with blockchain for their own business operations.

‘Blockchain 3.0’ introduced the ‘web3’ phenomenon and represented blockchain’s first foray into the mainstream. With developments in decentralised finance, NFTs, and concepts related to decentralised infrastructure, identity management, and governance, this stage expanded blockchain’s applications even further. It also marked a shift towards consumer-oriented applications in areas like gaming, collectibles, and digital identity. Venture capital investment in emerging technologies surged, coinciding with institutional investment avenues catering to professional and high-net-worth investors, leading to the term ‘digital assets’ gaining prominence in institutional contexts.

‘Blockchain 4.0’ signifies the current enterprise era. Building on the trends of ‘blockchain 3.0,’ in this stage enterprises and institutions now actively participate in product development and service provision. Banks offer cryptoasset investment platforms, well-established brands release their own NFT collections, and governments plan their digital currencies. Simply put, established brands, financial institutions and governments have entered the space previously dominated by crypto-first or crypto-native entities, and this forever blurs the lines between ‘crypto’ and traditional finance. The evolving landscape hinges on the competition and dynamics between private and public digital currencies and individual versus enterprise visions.

A narrative has come into view.

An ecosystem map

Today’s enterprise and institutional landscape presents an unprecedented array of possibilities, calling for a unifying perspective to navigate this multifaceted space effectively.

Consolidating the threads we’ve unravelled, we’ve traced the journey from crypto’s individualistic, investment-focused origins to today’s rapidly expanding expansive ecosystem.

To take the last step, we may choose to synthesise that narrative by using the graded scales of participants and applications to map the landscape of (a) investment use cases vs broader applications or utilities and (b) retail-facing vs more institutionally and enterprise focused offerings. Visualised in chart format, this provides us with a starting roadmap for understanding the digital asset landscape.

This is what provides the ‘helicopter view’ and launchpad to provide assessments of individual areas of enterprise digital asset activity – more on which in blogs to come!

Note: This article is abridged from the Zumo Digital Assets 2023 report. For the full report, please visit https://zumo.tech/digital-assets-2023/